Today I’ll be taking a look at yet another Spotify Wrapped-style feature from Monzo. We’ll discuss how they’ve done well, why it was a great opportunity for their growth model and a couple small areas to improve.

Spotify

It’s hard to argue that Spotify Wrapped has been one of the most impactful features on the tech industry as a whole. Spotify was not the first (Facebook tried a Year in Review as early as 2014, Source: Forbes), but they certainly were the best. Just like ChatGPT sparked the wave of new models, Spotify Wrapped has become so popular that many companies have tried to follow suit.

The latest company to give it a go is Monzo, having just released their new Year in Monzo. It is a little early to say whether or not it has been successful, but with numerous articles and plenty of Twitter/X activity in the first 24 hours it has definitely made a splash. Monzo did actually try this a few years ago (Source: Monzo) and must have scrapped it. Today, we’ll take a look at why the new Review is a good strategic fit and how they’ve excelled at this attempt.

Monzo’s strategy

Monzo are one of my absolute favourite product companies. It is very rare that they seem to miss the mark with their work. I’m not going to do a deep dive into Monzo today, as much as I’d like to, so I’ll give a very high level overview of how I think their strategy works. A few points:

Make Monzo your main bank

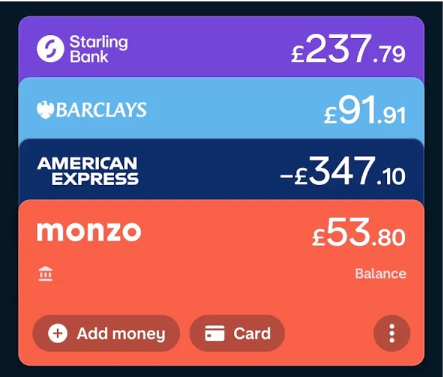

Monzo are not trying to make them your only bank, but they do want to be your main bank. They have taken full advantage of open banking and made it seamless for you to see your financial activity across all of your banks in the Monzo app.

Monzo have also recently added, Monzo Flex (credit card), Monzo Investments, and will soon be adding a pensions and home ownership product (mortages I suspect) and more will come in the future. These last two are not released yet, but Monzo have been hiring product roles for these domains specifically (Source: Google and Google). As your main bank, it’s more likely you’ll use Monzo for all of their additional services and make them the centre of your financial life. This is how the expand you as a customer.

Product-led everything

Monzo’s product-led strategy is art. Going back many years, it started with their viral acquisition strategy where customers could invite a friend for £10 and then later for £5. Their PLG strategy has now matured to focus on expansion. A lot of real-estate is used in the app to promote their additional products to convert their customers to additional use cases, such as using Monzo to invest.

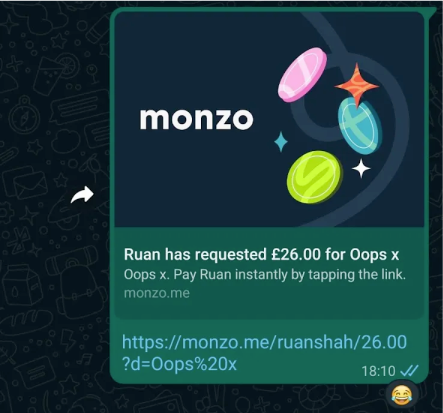

I won’t cover every product-led example, but plenty of their features have PLG baked in. A favourite of mine is how easy it is to send payment requests to your friends. These requests can be product-led acquisition (non-user signs up), product-led engagement (existing user returns to the app) or product-led marketing (non-user is exposed to Monzo).

Make banking fun

This is by far the most important point, and ties the strategy together. Monzo isn’t fun for the sake of fun. It’s fun to drive very highly daily engagement. This high engagement makes it more likely that Monzo will be your main bank, and the daily time spent in the app gives Monzo plenty of opportunity to market their additional products to you in a product-led way. No other bank has achieved this and it is a genuine differentiator that powers so many aspects of their overall strategy.

What products are a good fit for a wrap up?

This is a real trend at the moment, but not every product should blindly do a wrap up as it’s not really suitable for a number of apps.

High natural frequency

Products that are meant to be used at a daily or weekly frequency are good candidates as there will be plenty of data available to summarise for the year. If your product is used monthly, or maybe even quarterly, there is unlikely to be anything worth sharing.

Value delivered increases with usage

The important point here is that cost does not increase with usage at the same time. For products like Spotify and Strava, you get more value out of them the more you use them, but you do not pay more for doing so. Plenty of products will deliver more value if you use them more, but the majority will not have a linear relationship between value and usage. Most products will reach a point where more usage will deliver less and less value, or even no value at all.

Two examples might be Medium and Instagram. The more I use Medium, the more articles I read and the more value I extract for the same cost. Instagram you could argue you get more value from spending more time on the app indefinitely, but do you think spending 4 hours a day cures 8x more boredom than spending 30 minutes a day? I think not.

Products with social built in

I’ll use Spotify and Strava again. Strava is a social app, and Spotify has social built in. These are good examples as they show that social does not need to be the primary function of the product for a wrap up to be a good fit, but there does need to be social aspects to the product otherwise the chances that users will share their wrap ups is pretty low. If I’ve never shared something from the app before, it’s unlikely I’m going to suddenly start because you wrapped up my year.

What makes Monzo a good fit?

Product fit

Based on the above, let’s think about how Monzo as a product is a good fit. Spending money/managing your finances has a high natural frequency, and we’ve covered how Monzo try encourage that behaviour to happen in their app by making it fun.

In terms of value and usage, we need to be careful not to think of this as: the more people spend the more value they get out of Monzo. Rather, for their spending habits, the more that happens through Monzo they more value they can extract from their service. A good example would be their Trends feature. The more of my spending behaviour that is available to see in Monzo, the more value I can get out of using the app as it gives me the most accurate picture possible of my habits. This also scales as my spending habits increase or decrease.

Finally, Monzo does have inherent social value. It’s not social like Strava does social, but plenty of Monzo functionality is geared towards spending or managing finances together. It’s about as social as finance can be.

Strategic fit

I can’t say what didn’t work about Monzo’s previous attempt to do a wrap up, but I can make some guesses about why it will likely be very successful this time. First, I’ll cover a few things I think they have done well:

Unique insights

A trend I have seen with some of these wrap ups is simply to amalgamate all of your data and share that as an insight. Monzo have done that to add some bulk (not every insight needs to be unique), but the majority of the Review shows you insights that you couldn’t have known yourself.

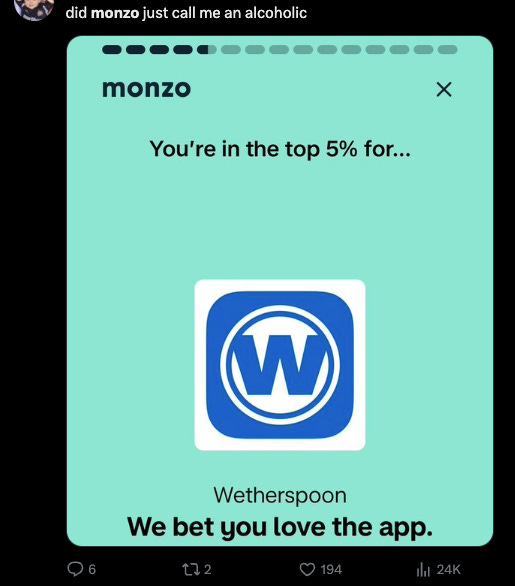

A little bit of of controversy

For a bank, Monzo’s brand is pretty different. They like to be tongue-in-cheek and ruffle a few feathers with their marketing content, and it’s a differentiator for them compared to any other challenger bank. Good product strategy leverages your strengths. The team have done a great job of leveraging the strategic advantage of their brand in the design itself. The image above is very Monzo. You’re looking at it and thinking, does someone really want to know they’re in the top 10% of KFC customers? Probably not. Do Monzo know this? Well…

A new acquisition loop

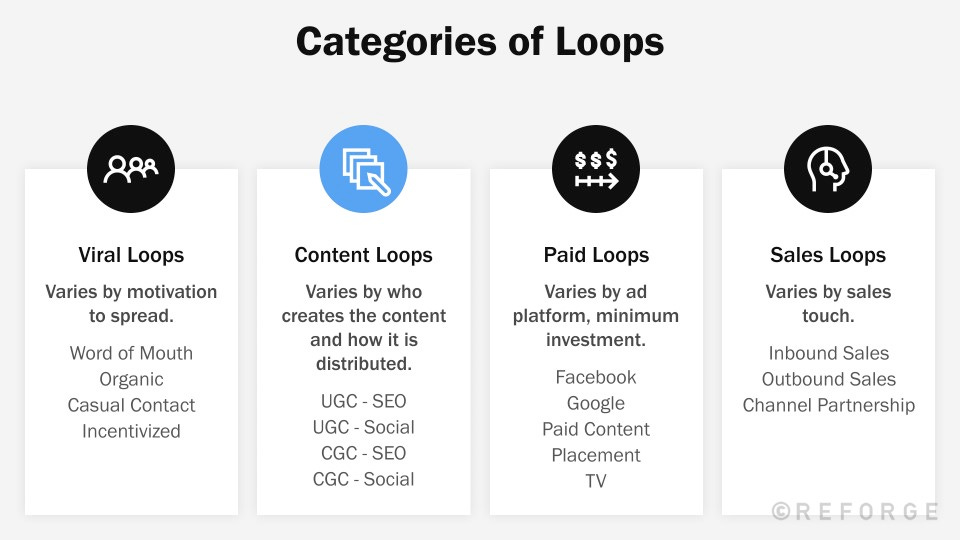

Acquisition loops can generally be categorised into four buckets: viral, paid, sales content. I won’t cover paid or sales loops here, but these are primarily related to ads and sales and the user doesn’t really drive the loop like they do in viral and content loops. In terms of viral loops, Monzo has many variations with some examples here:

Incentivised - Example being the referral bonus for inviting a friend to Monzo.

Word of mouth - Monzo is so good to use, it’s a safe assumption that plenty of users have signed up based on a recommendation from a friend.

Organic - This was how I signed up. My housemates wanted to create a shared tab so that we could manage house payments in one place, so I signed up to Monzo.

The incentivised and organic loops definitely have some overlap to create a powerful acquisition strategy. In my example, not only did my friends ask me to sign up, we even got a reward if I did. Double whammy.

The reason to share this is to show that Monzo are already doing pretty well with their viral and paid acquisition loops. An area to improve was content loops. There are two types of content: user generated content (UGC) and company generated content (CGC). Each of these can be distributed by the user or by the company, creating 4 variations of content e.g. user generated, company distributed. UGC is not really suitable for Monzo, so they’ve gone down the route of CGC to create the new acquisition loop.

Last year, Monzo experimented with company generated, company distributed content with their 2022 version of the Year in Review. I think this was likely an experiment ahead of this years review. Monzo created the content, and then that was distributed on their socials. I can’t find any images unfortunately, but they curated some insights from spending behaviour across all users.

The limitation of company distributed content is the reach; it will usually only go as far as the company’s social graph extends. User distributed content on the other hand will extend to their own social graph. Monzo provided the company generated content for each user and, using a little bit of controversy, they have made something that is very likely going to be user distributed by sharing it on social media or with friends.

This was a very long winded way of explaining that Monzo wanted to build out a new acquisition loop, and company generated user distributed content was a lovely addition to their growth model.

How could they improve next year?

A couple areas jump out to me as potential areas to improve. I’m in no position to suggest any sweeping changes, I’d be completely guessing, so I’ve opted for a couple of small optimisations that both tie into what Monzo has done well and their overall strategy.

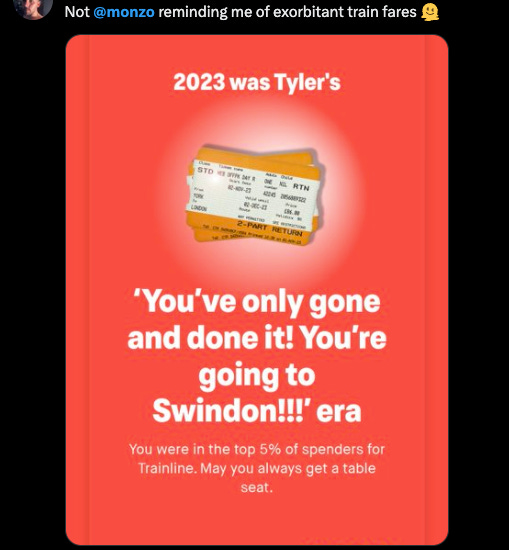

The right kind of controversy

The controversy they’ve utilised will for sure divide opinions, but in general I think Monzo really hit the mark. The examples I shared previously, like the KFC one, are funny. It’s not really the kind of thing you want to know, but once you do know it it’s definitely going straight on social media.

The example above I don’t think is the kind of insight that will illicit the same reaction. Although this has been shared on social media, it’s has much more negative sentiment. An improvement I would make would be to steer clear of any controversy that might tie to the current political landscape in the UK. Anything to do with the cost of living crisis isn’t likely to receive a positive reaction, and isn’t in keeping with how Monzo has spoken about the crisis before (Source: Monzo). The Review leveraged the Monzo brand very well, but this insight was slightly off-brand.

Use all available data

I noticed with my Review is that it only used my Monzo data specifically. Although I can see all of my spending in the Monzo app for my other cards, my Starling and Amex data was not included. There’s a good chance there’s a legal/regulatory reason for this, but if my banking data can be used in Monzo already it does seem strange that it couldn’t be used as part of the Review. Maybe some Fintech people out there might know more about this!

The limitation of not using all available data is that the insights are not truly accurate. Some of the things Monzo shared with me about my spending habits just aren’t correct; they’re just correct for my Monzo spending. Remember, Monzo wants to be your main bank not your only bank. If the reason is not legal/regulatory, my guess would be that Monzo chose to use Monzo-only data to try and drive more spending ahead of next year’s Review. That to me is more of an engagement play, trying to deepen use of Monzo, but the Review is much better suited to acquisition.

Final words

If nothing else, I do think these yearly wrap ups are good fun. Some companies might do them just for the marketing splash, and I’m on board with that.

As I’ve shared their content here, I’d like to give a really quick shoutout to Reforge. Almost everything I have learned about growth this year has come from their courses. Can’t recommend them enough.